INTRODUCTION

The COVID-19 pandemic had tightened its stranglehold over the world in recent months and lead to strict social-distancing measures being adopted in most countries in order to reduce the number of cases and help bring life back to a sense of normalcy. Large banks have consequently reported a huge surge in contactless card usage during the same timeframe owing to the effects of the pandemic as people are worried about touching surfaces and would much rather tap their credit cards and phones instead. Nevertheless, contactless payment options are not a new technology since there has been a broader shift over the past several years where many technology companies such as Apple, Google, and Samsung introduced their versions of smartphone technology payment ecosystems, which have also been accepted by many more merchants as consumers begin to increasingly use them.

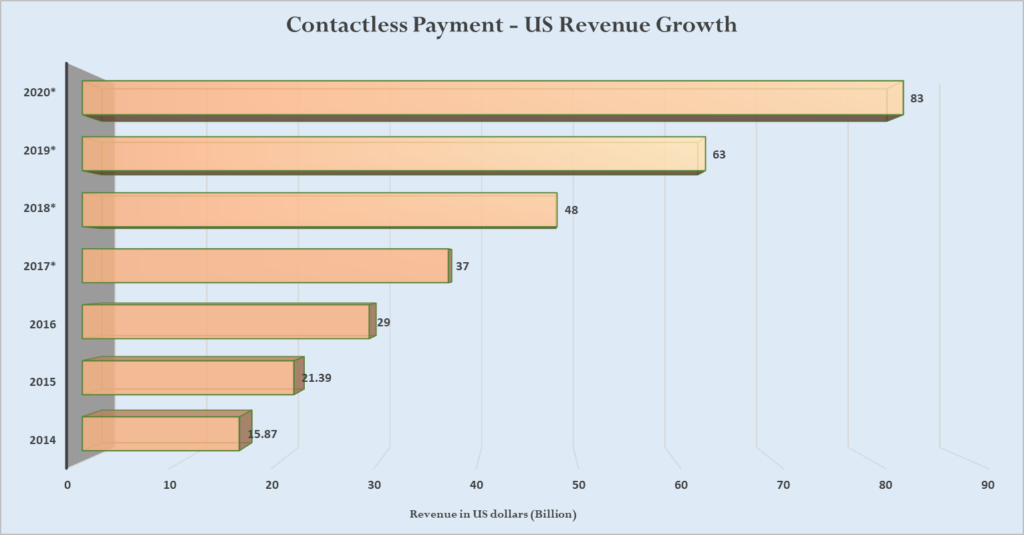

The revenue generated from the use of contactless payments within the US has been on a steady increase and is projected to increase even further as more and more consumers adopt it, particularly in the aftermath of the pandemic and the lingering wariness of touching surfaces in public spaces.

Types of Contactless Payment Options

- Debit cards

- Credit cards

- Online payments

- Mobile payments

- Cryptocurrencies

- Person-to-person (P2P) payments

Why the Use of Contactless Payments will Increase in the US

There are several contributing factors that will lead to an increase in contactless payments within the US in the coming months which would ultimately result in their ubiquity:

- Consumer Demand

As I mentioned earlier, the effects of the global pandemic have made many consumers wary of touching surfaces in public spaces and many are now finding it a necessity to utilize contactless payment options as opposed to cash, and even trying to avoid having to punch in their pin numbers or enter signatures on the point of sale terminals. Contactless payment options serve as a suitable alternative that will dramatically increase their usage within the US.

- Accessibility of Contactless Cards from Banks

Major banks and credit card issuers in the US have recently increased the availability of touchless-enabled debit and credit cards to their customers as either replacements to their existing ones or provided to new customers whenever they open up new accounts. My banking branch already contacted me recently to make me aware that they will be replacing my current credit card with a touch-enabled version of it upon its expiration in a few months. This is an example of a major trend that is currently occurring across the banking sector in the US.

- Business Adoption

With most major retailers and merchants across the US upgrading their check-out systems and accepting various forms of contactless payments, it makes it an easier customer experience and further promotes the increased adoption of these new forms of payment options. The higher the number of businesses that utilize contactless payment options, the higher the number of customers that are likely to use them to make payments for products and services.

AMAZON GO

Amazon has slowly been rolling out a new form of contactless payment referred to as “Amazon Go” in some of its Whole Foods stores, a process that fundamentally works using technologies based on Machine Learning, Computer Vision, and Artificial Intelligence (AI). This form of contactless payment allows a customer to walk into a Whole Foods store, scan their Amazon Go app, then pick out anything they want to purchase from the shelves – which then gets added to their virtual cart. Once the customers are done shopping, they simply walk out without going through a check-out register or standing in line. All items they walk out of the Whole Foods store with will get charged to their credit card on file with Amazon.

Similar to self-driving cars’ technology, this form of contactless payment uses computer vision, deep learning algorithms, and sensor fusion capabilities to allow for the elimination of check-out registers at the Whole Foods stores, and instead, have the Amazon Go technology stack drive the entire lifecycle of the transaction process. If a customer decided to return an item while at the store, it can automatically remove that item from the customer’s virtual cart so that their Amazon account won’t get charged for it once they leave the store, and all receipts are sent straight to the app.

SUMMARY

It is more evident that contactless payment options are becoming ubiquitous not just in the US but globally. The COVID-19 pandemic has accelerated the rate at which more consumers are embracing contactless payment options and using cash at a reduced frequency because of the pandemic’s inherent uncertainties tied to hygiene and sanitary concerns. From a business perspective, it also becomes easier for them to capture and maintain data for customer loyalty programs, which they can use to improve the products and services they provide, and subsequently increase customer satisfaction.